Self employed, voluntary members and overseas Filipino workers who have already paid their contributions in advance for the applicable months onwards based on the old contribution scheduled are advised as follows:

SSS contributions are required by law for privately employed individuals. Each month, employer will deduct 3.36% from your basic salary. Upon payment to SSS, employers will then add an amount equivalent to 7.37% of your basic salary. Your total contribution will now become 11%. However, maximum salary credit is only at P16,000.

images credit: SSS Website

The New Contribution Schedule will be implemented for the applicable month of April and payable in May 2019.

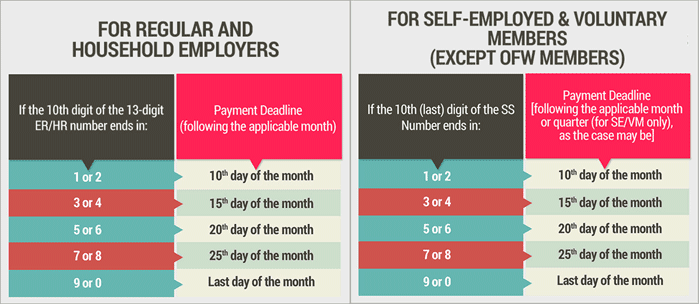

Payment due date of SSS premiums are based on the 10th digit of a member’s account number.

What can you say about the new SSS Contribution Table? Will it benefit us members more?

Tag

Alamat

49

Blogger Tutorial

1

Computer and Internet

2

Entertainment

1

Filipino Folk Song

6

Filipino Heroes

10

Filipino Native Games

4

Filipino Street Food

6

Funny Photo

1

Health

4

History

23

Kwentong Bayan

23

Life Hack

3

Love Story

5

Maikling Kwento

4

Makabayan Song

1

Mobile and Network

4

Nobela

1

Pabula

13

Panitikan

30

Parabula

7

Philippine President

15

Phone

1

Pinoy Full Movies

2

Pinoy Jokes

30

Tagalog Movie

14

Tagalog Quotes

41

Talumpati

4

Tip and Tutorials

1

Travel

3

Trending

10

Tula

14

Uncategorized

10

Video

9